november child tax credit not received

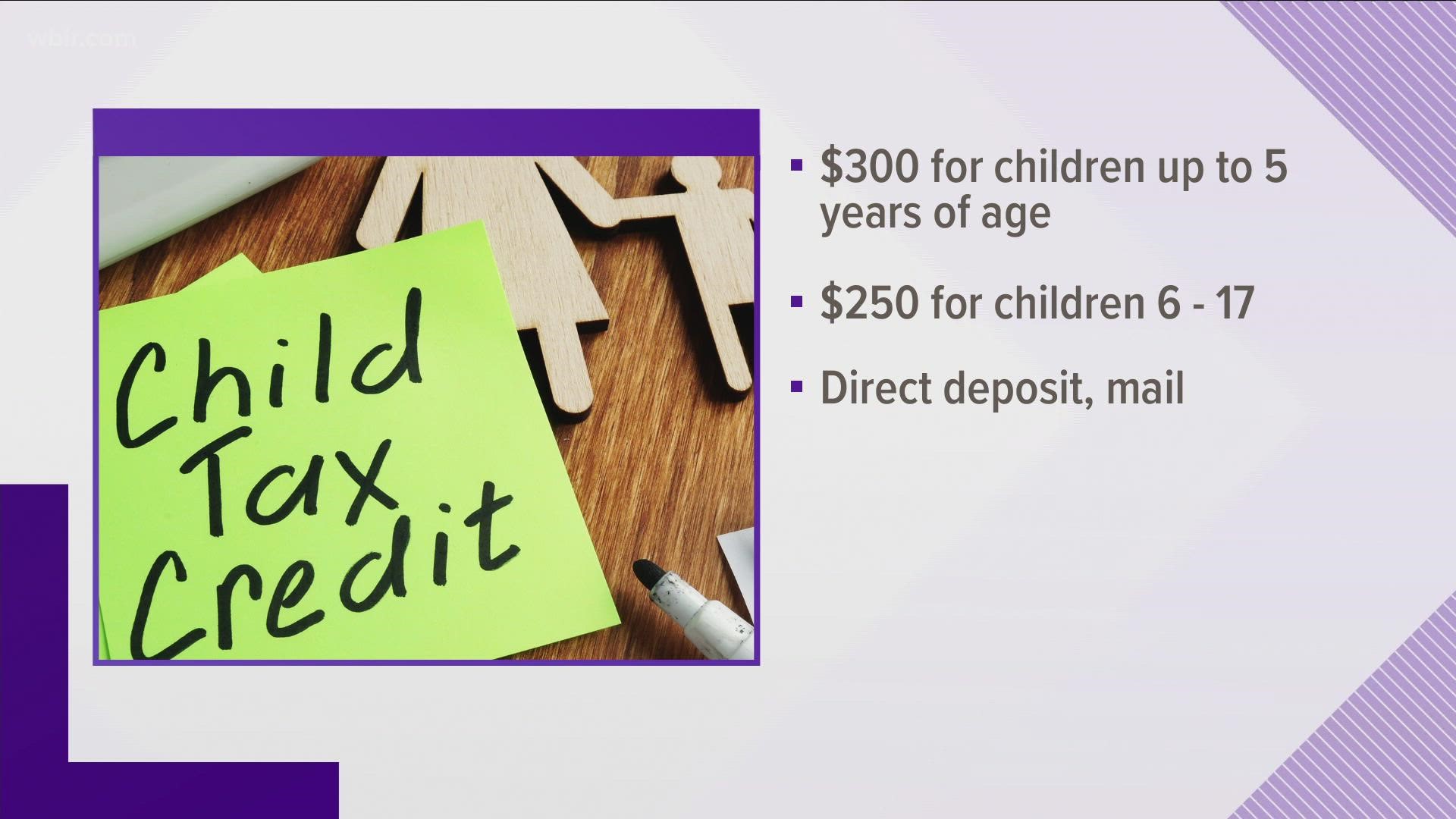

The deadline to sign up was November 15 so anyone who is eligible for the expanded Child Tax Credit but didnt register in time will have to wait until they file their taxes. Under the Child Tax Credit children who are 6 or younger should receive 300 per month while children ages 6 to 17 will receive 250 per month.

The Child Tax Credit Toolkit The White House

Low-income families who have not received advance payments because they do not typically file a tax return have until Monday night Nov.

. Child tax credit payments do not count as income. Under the expansion parents can receive a tax credit worth as much as 8000 nearly four times the previous limit of 2100. The bill was enacted in March to help families get back on their feet amidst the Covid.

The expanded Child Tax Credit by comparison. Its also important to note that if youve been a victim of tax-related identity theft you wont receive child tax credit payments until those issues have been resolved with the IRS. Treasury and IRS Announce Families of Nearly 60 Million Children Receive 15 Billion in First Payments of.

Eligible families who did not opt out of the monthly payments are receiving 300. If you received a higher amount of child tax credit payments than allowed by the IRS its possible youll have to pay back a portion of that child tax credit money when you file your taxes this year. If you qualified for the full tax credit amount of 3600 for your newborn baby you could.

15 to sign up to receive a lump sum. If you have a child aged 6-17 you will receive 250 per qualifying dependent child. So my wife and I filed jointly and both have same information on portal.

8 Department of the Treasury. Eligible families who do not opt out of monthly payments will receive 300 month for each. IR-2021-222 November 12 2021 WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon.

The fifth installment of the Child Tax Credit advance payments will be sent out on November 15. Those who have already signed up will receive their payments after they are issued. Eligible families were able to receive 50 of their estimated child tax credit in 2021.

Half of the total is being paid as six monthly payments and half as a 2021 tax credit. In order to check the status of your payments or see if you will be getting a. So parents of a child under six receive 300 per month and parents of a child six or.

But there have been delays in previous. Then early September status of eligibility. Credit 3600 per year for children under 6 years old Children 6 to 17 years old.

The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. In theory the November 15 payment should have been received. November child tax credit payments are expected to be issued in the coming weeks.

November 22 2021. But theres a catch. We received both August and July DD no issues.

Your marital status and whether or not your children live with you for at least 6 months out of. However if you no longer qualify for the full amount but you receive the full amount anyway you may need to pay back. Why are the November Child Tax Credit payments delayed.

The monthly child tax credit payments which began in July are set to end in December.

December Child Tax Credit What To Do If It Doesn T Show Up Wusa9 Com

December Child Tax Credit Why Some Parents Were Only Paid Half And What To Do If You Didn T Get It At All

Child Tax Credit Update Next Payment Coming On November 15 Marca

Child Tax Credit Another 1 800 Per Child Could Come With Your Tax Refund Cnet

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet